Non-Warrantable Condominium Purchase under Streamlined Condo Review at 89.99% CLTV

We obtained a combo loan — consisting of two loans — for our client to purchase a non-warrantable condominium in Miami, Florida as her primary residence. Our client was facing several challenges when she first met us. First, she was previously turned down by another lender because the underwriter discovered that the condominium association lacked […]

Rate-and-Term Refinance to 2.875% for Prior Client

On behalf of our client, who we previously helped obtain a purchase loan for her condominium unit in Miami, Florida, we refinanced her into a 30-year, fixed-rate mortgage at a lower interest rate of 2.875%, and a loan-to-value (LTV) of nearly 90%, under Freddie Mac’s Home Possible program. As a result of the rate-and-term refinance, […]

Combo Loan at 81% CLTV at 2.75% for Newly Constructed Home

We obtained another combo loan — consisting of two loans — for another one of our clients to purchase a new home, this time a $750,000 newly constructed home in Miramar, Florida. Also known as a combination loan or piggyback loan, a combo loan is when the borrower takes out two separate loans for the […]

Foreign National Loan for Brazilian to Purchase Investment Property in Aventura, Florida

On behalf of a foreign national from Brazil, we obtained a loan for him to purchase a condominium unit in Aventura, Florida as an investment property. The terms of his loan included a 30-year fixed interest rate and 65% loan-to-value. Under this lender’s foreign national program, the borrower’s income does not have to be verified. […]

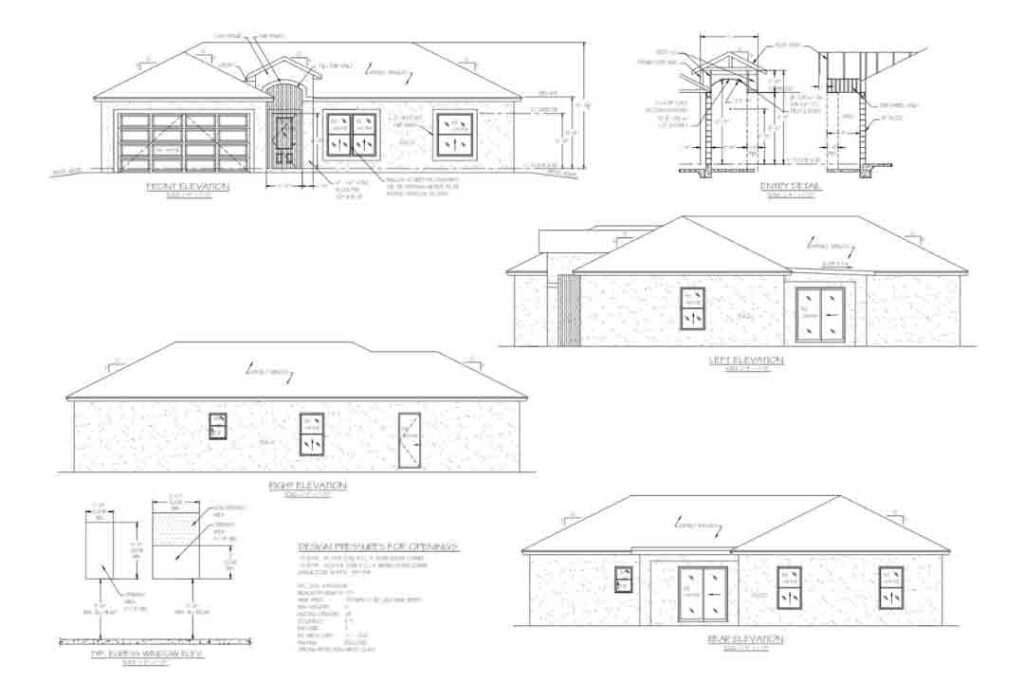

Construction Loan to Build Spec Home in Stuart, Florida for Self GC’s First Project

On behalf of a general contractor with minimal experience, we obtained a construction loan for him to build a spec home in Stuart, Florida. Having recently purchased the vacant land, our client needed funds for the ground-up construction of a single-family residence. In only three weeks, we were able to close his loan with the […]

$1.275 Million Refinance: Unlock Financial Freedom with the Bank Statement Program

A Successful Refinance Using the Bank Statement Loan Program The bank statement program is a great alternative for borrowers who can’t show income through traditional documentation such as tax returns. Our clients, a self-employed husband and wife, were in dire need of refinancing their primary residence in Lighthouse Point, Florida. With a looming interest rate […]

Homebuyer Qualifies on Minimal Income Documentation under Super Creative Program

Our client was under contract to purchase a new home in Key Largo, Florida. But, he was having a hard time getting approved for a loan due to his difficulty with proving his income. First, he tried going to his bank. However, his bank denied his loan application because he was not able to qualify […]

Hard Money Loan for Foreign National Closed in Only 1 Week to Purchase $1.6 Million Condo in Florida

In only 1 week, we obtained a $1 million purchase loan for our client, a foreign national from Mexico, to acquire a $1.6 million investment property in the Miami neighborhood of Brickell. Our client, who had previously been turned down by two other lenders, needed minimal documentation requirements and a fast closing. On a Monday, […]

Purchase Loan for $1.8 Million Florida Beach House Despite Negative Credit History

On behalf of a doctor and his wife, we helped them purchase a $1.8 million property on the west coast of Florida, their dream home. Their biggest obstacle was their credit history. The doctor had some derogatory accounts, including a charge-off on a Small Business Administration (SBA) loan. The amount owed on the SBA loan […]

Unlock Your Dream Home with the Bank Statement Program for Self-Employed Borrowers

Bank Statement Program: A Tailor-Made Solution for Self-Employed Borrowers A bank statement program is a great alternative to qualify for a loan when the traditional avenue of providing tax returns is simply not available. Our clients, a husband and wife duo running a successful clothing and apparel business, faced rejection by their bank when they […]